- #Free tax software for 2016 for free#

- #Free tax software for 2016 professional#

- #Free tax software for 2016 free#

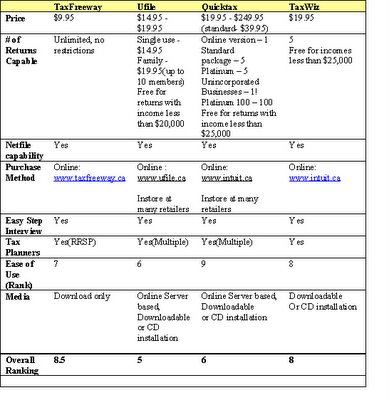

The filing process is relatively straightforward, though in terms of robustness, some of the paid services offer more.

#Free tax software for 2016 free#

The biggest selling point by far for Credit Karma is that it is a completely free service, and that includes free auditing protection, which is a great added bonus. Credit Karma makes money on matching leads to the products most likely to tempt their users, but users are clearly made aware that this is the model. Free usually means that the software is limited or harder to use, but Credit Karma manages to avoid both these pitfalls.Ĭredit Karma uses the data it has about each user to show them specific credit-related products offered by third parties such as banks. Overall, customers will appreciate the value of their packages and the functionality that’s on a par with anything on the market.Ĭredit Karma is really the only company offering a completely free tax returns service this is only possible due to its advertising-driven business model. The levels of included support are slightly lower than those offered by TurboTax and H&R Block, but users can pay extra for one-on-one expertise. TaxSlayer's software is straightforward and easy to use, and the variety of versions means that the vast majority of tax payers will find one to suit them. Additional state returns will cost $32 per return.

There's even a free option for people who have a simple tax situation (Basic 1040), which includes one free state return. This makes a notable difference for any level of tax return complexity, but especially at the higher, most advanced levels. TaxSlayer’s prices are a huge selling point, and its comparable packages are consistently more competitively priced than many of its rivals. TaxSlayer has a long company history and its transition from bookkeeping into one of the major players in the tax return software industry has been solid move. Then all you’ve got to do is decide what to spend the refund on. The following overview highlights the best software packages around, from free versions to those with additional levels of functionality, as well as those best for advance refunds and even the one with an accuracy guarantee.

#Free tax software for 2016 professional#

Alternatively, those with more complex financial needs could opt for a paid-for package, but even here, the costs involved will likely be far lower than hiring a professional accountant.Įither way, you want to make sure you’re getting the best tax software possible, which is where this guide comes in.

#Free tax software for 2016 for free#

Indeed, those whose taxes are relatively straightforward may want to look for free tax software, which should have everything necessary to complete basic accountancy tasks.

There’s no need to pay for a tax expert, either, which could make the whole process far more affordable. Not only will filing become a breeze, but the very best tax software could enhance your refund by helping you maximize any credits and deductions you could be entitled to, all with a high level of support.

0 kommentar(er)

0 kommentar(er)